The last bank in town set to close

If you live in or near Totnes, the planned closure of the Lloyds Bank Branch in January may well impact you.

Bank outlets are closing down throughout the UK and Lloyds is the last bank in Totnes. With a popular and relatively thriving high street dependant on it’s services, it seems incredible that LINK – a group whose website claims “Most people find accessing cash easy. It’s our job to keep it that way” – according to our MP Caroline Voaden, deemed Totnes banking services to be adequate, limiting the chances of opening a banking hub in the town. She states “The moment the closure was announced, I submitted a cash review request through LINK, the public body responsible for assessing local needs. I expected this review to confirm what we all know: that come January banking services in Totnes will be insufficient, thereby requiring a Banking Hub to open.”

HSBC, posted close to an 80% rise in pre-tax profits of £24 billion for 2023 & Lloyds claim it was up 57% to £7.5 billion

Really?

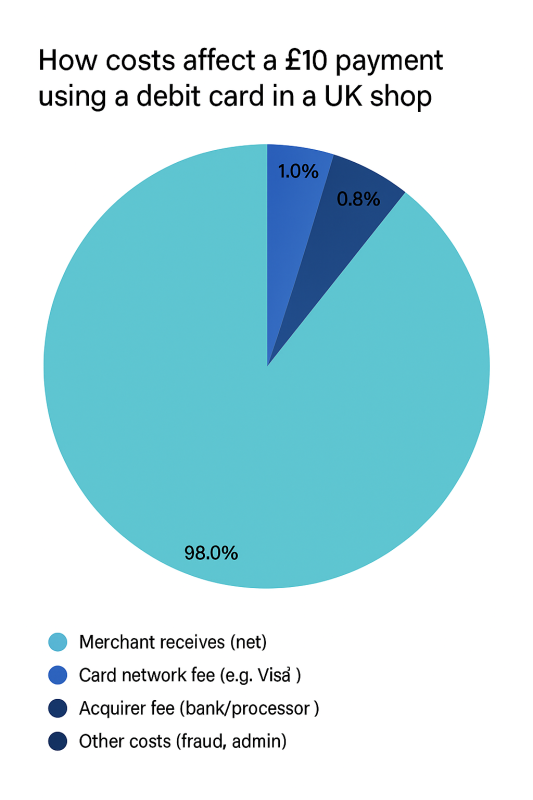

It’s difficult to recognise how they could have claimed adequacy when the only source of change in the form of coins would be the already very busy Post Office. It appears that the UK is being forced to abandon cash in favour of Debit cards. The bottom line of banking profits won’t be hurt of course by no longer providing high street services and in turn, benefitting from taking a small cut of every single card transaction, further reducing the profit margin for shopkeepers. There are other factors of course but HSBC, posted close to an 80% rise in pre-tax profits of £24 billion for 2023 & Lloyds claim it was up 57% to £7.5 billion.

According to Brunel University London, in March last year: “…cost reductions look set to continue in 2024. Lloyds recently announced more than 2,500 job cuts to restructure its business with a focus on digital services. Barclays and Santander may end up doing the same, while similar levels of redundancies have been seen in the US and the EU.”

The day to day effects of digital banking

The effects of digital banking can be profound with older adults, rural communities, and low-income groups struggling with access or digital literacy, risking exclusion. Other effects are that people are less likely to carry cash, which alters tipping, gifting, and informal economies. There is also reduced anonymity: Unlike cash, digital payments leave a traceable footprint, raising concerns about surveillance and data privacy, government could gain more visibility into transactions.

There are also dangers regarding resilience and risk: Digital systems are vulnerable to outages, cyberattacks, and technical failures, which can disrupt access to funds. As this article is being written there is an outage affecting Lloyds Bank online banking services as well as multiple other services. It was only last year several major chains including Morrisons were unable to process card payments. As reliance on digital systems continue to increase, these problems will inevitably become more frequent.

These alterations to our daily lives also seem to have the highest impact on the poorest in society, for many, cash remains a vital tool for budgeting, autonomy, and privacy. Its decline can marginalize those who rely on it and european countries are considering legal protections for cash access to ensure no one is left behind. The same goes for the UK.

What next for Totnes?

With LINK claiming Totnes has adequate provision – presumably through the 3 or 4 ATM’s in town and the most accessible banks being located just a swift bus ride away in Paignton or Torquay, Caroline Voaden has instigated a petition to help establish that the citizens of the region may think otherwise.